Payoneer: The Complete Payoneer Review 2022[

Before the creation of Payoneer, How can you send money to a friend, family member, or freelancer overseas when they don’t have an American bank account? If you’re like most people, you might have thought that it was impossible to transfer money internationally unless the receiver had a U.S.-based bank account. However, with the help of Payoneer, you can pay anyone in the world without needing their bank account information or even living in the same country as them.

When it comes to growing your business on the internet, it’s important to try everything you can to make it more successful. While SEO and keyword research have been staples of internet marketing for a long time, new technologies are consistently emerging that can improve how you market yourself and your products and services. One of the most recent developments in this field is Anyword review, an artificial intelligence platform that has proven incredibly useful for anyone who wants to grow their business through content marketing but doesn’t want to spend hours writing or editing articles and blog posts.

This review will explain everything about this innovative platform and how it works so that you can decide if it’s right for your online payment needs.

How Do I Sign Up For Payoneer?

Signing up for a Payoneer account is relatively straightforward. You’ll start by setting up an account on their website and then verify your identity by providing details such as your name, address, social security number (or EIN), date of birth, bank account information, and tax forms. Next, you’ll fund your account with at least $10 (although you can fund it with more) and then verify your funding source. Most people use their bank accounts for verification but PayPal accounts can also be used.

CLICK HERE TO SIGN UP ON PAYONEER NOW

Is Payoneer Secure?

The first thing to understand about Payoneer is that it is a very secure payment portal. This means you can use it for both receiving and sending payments, thanks to its advanced security features that keep your data safe at all times. The platform uses bank-level security to protect any information you share with it and to guarantee your money is always protected from fraud. Additionally, users have a good amount of control over their accounts, meaning they can choose how they access them.it can also be used to receive affiliate marketing commissions.

How Does it Work?

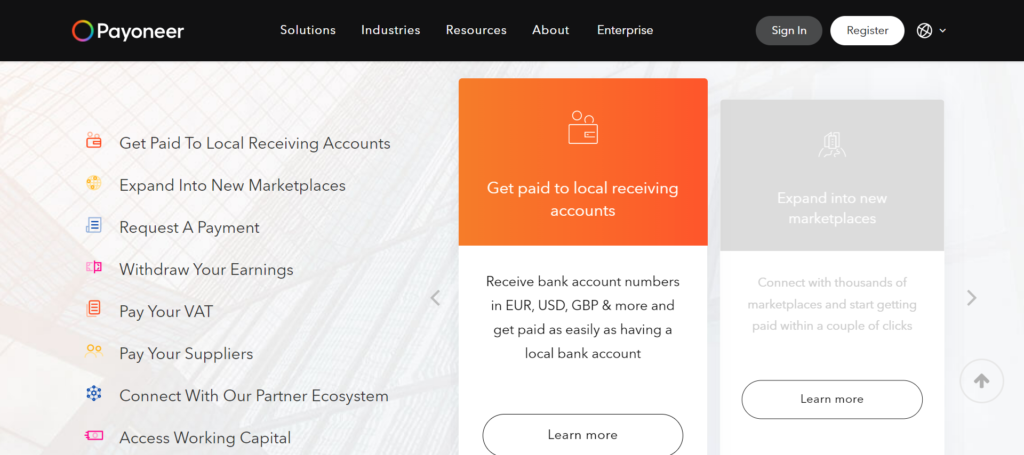

Payment portals are platforms that can be used to receive and send payments online. They’re similar to services like PayPal but usually offer better rates for receiving funds and lower fees for sending them. However, unlike most payment portals, Payoneer is designed specifically for freelancers who want to accept payments from overseas clients. It doesn’t just connect you with people willing to pay in your local currency—it also lets them make bank transfers as easily as they might through PayPal or Venmo.

What are the Payment Options for Consumers?

There are a few ways that you can be paid through your Payoneer account. The most typical way is through direct deposit to your bank account; however, you can also opt for receiving payments on your credit card or even via a cash pickup. Each of these payment options has its own advantage and disadvantage depending on what you need out of your online business.

While online payment portals like PayPal have built up a loyal following over time, there are significant advantages to using an alternative method to receive payments. Having multiple payment options gives consumers more flexibility in how they’re able to take home their earnings, which is definitely worth considering if you haven’t yet settled on an option for receiving payments.

How Much does it Cost?

Online payment portals are typically free to use and don’t charge any fees. That said, there may be some costs that come along with setting up your account. In fact, PayPal charges a small fee just to open an account. However, once you have an account set up with a popular platform like PayPal or Venmo, there are no hidden fees; you can send and receive money on either end without being charged extra for currency conversion or other services.

The only risk is if you have fraud protection turned off (i.e., you don’t cover your payments). If someone pays into your account but then requests a refund before they hit Pay, their payment will come back as pending—you’ll need to wait until it clears in order to access it again.

Who Can Use it?

If you have ever wanted to send and receive money online without any restrictions, you need to learn about Payoneer. The platform makes it possible for people all over the world to exchange funds in their local currency. The transaction fees are much lower than they are with services like PayPal or Western Union and there are no trading restrictions when moving money between countries. In short, you can use Payoneer review to send money anywhere on earth at any time of day at little or no cost, so it’s ideal for anyone who operates online.

Is There A Mobile App?

There’s no official mobile app for Payoneer (yet), but there are plenty of third-party solutions that you can use to manage your account from your phone. The most popular way to check and send payments is by downloading Xoom, which has apps for Android and iOS devices.

If you want a more streamlined approach, try TransferWise. This service allows you to transfer money directly from your bank account into an account at a participating partner bank – or vice versa – for free. (Note: TransferWise is only available in certain countries.)

What Countries Support It?

One of my favorite things about Payoneer is that it supports 170 countries and territories. This means you can receive payments from people all over the world, but they don’t have to be in your local currency. There are many downsides to working online. One of those is not being able to pay or get paid in different currencies. So being able to create a global business with no local limitations is awesome.

For example, if someone wanted to pay me in Euros while I lived in Hong Kong, I wouldn’t need to worry about finding a new payment processor or having my money converted into Hong Kong dollars; I could keep everything simple by receiving funds directly into my bank account (without any additional costs).

How Do I Transfer Money From My Bank Account to my Payoneer Account?

You can transfer money from your bank account to your Payoneer account in two ways. The first way is by paying for a service or product with a check that’s made out to your name and then receiving those funds into your account. Alternatively, you can request an ACH transfer (direct deposit) from one of your U.S.-based accounts, provided that you have documentation that proves you own it.

Unfortunately, international accounts and credit cards are not accepted as funding sources at present time. If you’re on a Mac, check out Money Transmitter (US), which makes transferring money very easy; to use it, visit Payments -> Transfer in System Preferences and enter your information there.

Does Payoneer Charge Fees When I Send Money Abroad?

Probably not. In most cases, you won’t have to pay anything extra when you send money abroad through your U.S.-based Payoneer account—though there may be some instances in which a small fee is charged (see How Much Does It Cost to Send Money Internationally with Payoneer? for more details).

If you’re trying to minimize fees, we recommend only sending money within countries that are part of SWIFT or SEPA (Society for Worldwide Interbank Financial Telecommunication) networks and don’t require a currency conversion. Because of foreign exchange rates, it will cost more if you send dollars to a country where dollars aren’t typically traded.

What if I Have a Problem with my Account or With Transfers from my Bank Account to my Account in Payoneer?

Payoneer does everything possible to ensure that you can access your money as quickly and easily as possible. However, there is always a small chance that something might go wrong with your account. If it does, Payoneer has many customer service options that make it easy for you to find help 24/7 in a number of different languages.

They also have online forms that allow you to submit any issue you might be having without making a phone call or sending an email. If you have further questions about specific issues with transfers from your bank account to your account in Payoneer, simply ask them via email or live chat!

What is a NINo Number, and Do I Need One to Open an Account with Payoneer?

If you’re sending or receiving money internationally, you’ll need a NINo Number. Without it, your account with Payoneer can only be used to transfer money between domestic bank accounts in different countries. And while getting a NINo isn’t difficult, it can take weeks to get.

You may also need proof of identification and address and some new businesses may have difficulty proving their legitimacy. So we definitely recommend working through all of these factors before opening an account with Payoneer.

How Do I Register My NINo Number With Payoneer?

If you are in need of a payment method that is an alternative to PayPal, you may be wondering if there is an option for you. Yes, there is! Payoneer offers a virtual MasterCard that can be used to withdraw funds from your account. The card can be used online or when shopping offline. To set up your account and ensure you receive your card, click here now to sign up for free